[ad_1]

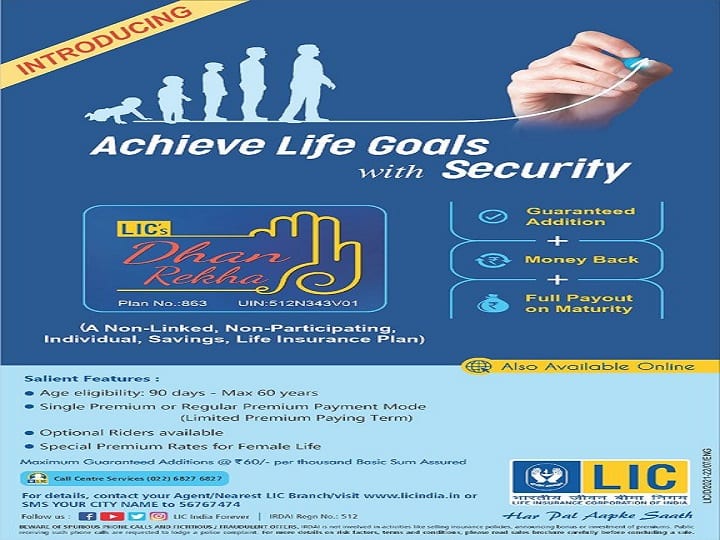

LIC Policy Dhan Rekha Plan: Millions of people of the country still trust the country’s largest public sector insurance company LIC i.e. Life Insurance Corporation of India. Most prefer to invest in LIC for the middle class. The reason for this is that it is away from market risks and there is no risk of losing money in it at all. One such non-linked non-participating individual savings life insurance policy from LIC is Dhan Rekha Plan. Under this plan, you can get Sum Assured up to 125 percent. In this policy, you can choose to pay premium, single or limited premium option.

Women get special benefits

According to LIC’s Dhan Rekha Plan, women get a special discount. Along with this, provisions have been made for third gender as well. According to this plan, you will get a part of the amount as survival benefit at some interval of time. Keep in mind that your policy should last only till that time. Because of this, investors get tremendous benefits from this. Along with this, after the completion of the policy, you get the full amount without deducting the money received earlier.

You can invest so much money in Dhan Rekha plan

To invest in this policy, you have to invest Rs 2 lakh. At the same time, you can invest as much money as you want. At the same time, you can take this policy in the name of the child from 90 days to the age of eight years. At the same time, the maximum age of this policy is from 35 to 55 years.

Dhan Rekha policy has been launched for these three terms

This Ghan Rekha policy of LIC has been launched for 20, 30 and 40 years term. You can invest in it for any term as per your convenience. In the term of 20 years, you will have to invest money for 10 years (Money Investment in LIC Dhan Rekha Plan). Whereas for 30 and 40, money will have to be invested for 15 and 20 years.

Apart from this, you can also invest money at one go. If a policy holder dies, the nominee will get the money along with a bonus of 125%. At the same time, on maturity, the policyholder will get 100% money.

.

[ad_2]